COMMODITIES

COMMODITIES

COMMODITIES

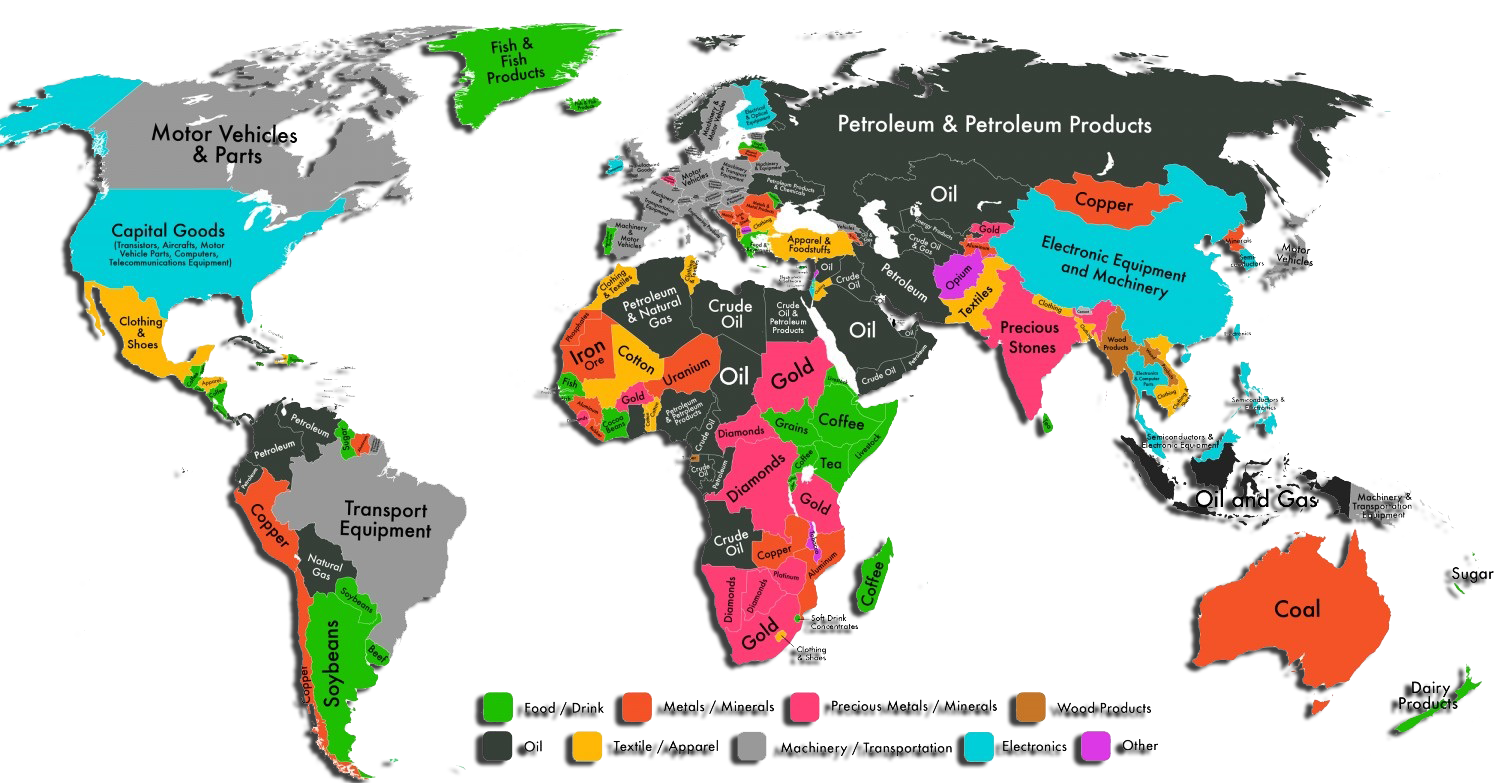

UTLC IS ONE OF THE MOST CREDIBLE INTERNATIONAL TRADERS AND AGENTS OF RAW MATERIALS, AUTOMOBILES AND DRY BULK COMMODITIES. COMMENCING ITS OPERATIONS IN 2006 BY DOING CLEARING AND FORWARDING, THE COMPANY HAS GROWN LEAPS AND BOUNDS IN ITS CREDIBILITY AS WELL AS ITS VOLUME OF BUSINESS. WITH A STRONG PRESENCE IN THE MIDDLE EAST MARKET, WE HAVE ALSO MADE OUR PRESENCE FELT ACROSS THE GLOBE BY TRADING IN COUNTRIES LIKE INDIA, AUSTRALIA, SOUTH AFRICA, KOREA, EUROPE, BRAZIL, AFRICA AND THE UNITED STATES OF AMERICA.

COMMODITIES CAN GENERALLY BE DIVIDED INTO FOUR CATEGORIES:

AGRICULTURAL: THIS CATEGORY INCLUDES FOOD CROPS (E.G., CORN, COTTON AND SOYBEANS), LIVESTOCK (E.G., CATTLE, HOGS AND PORK BELLIES) AND INDUSTRIAL CROPS (E.G., LUMBER, RUBBER AND WOOL)

ENERGY: THESE INCLUDE PETROLEUM PRODUCTS SUCH AS CRUDE OIL AND GASOLINE, NATURAL GAS, HEATING OIL, COAL, URANIUM (USED TO PRODUCE NUCLEAR ENERGY), ETHANOL (USED AS A GASOLINE ADDITIVE) AND ELECTRICITY

METALS: PRECIOUS METALS (E.G., GOLD, SILVER, PLATINUM AND PALLADIUM) AND BASE METALS (E.G., ALUMINIUM, NICKEL, STEEL, IRON ORE, TIN AND ZINC)

ENVIRONMENTAL: THIS CATEGORY INCLUDES PRODUCTS SUCH AS CARBON EMISSIONS, RENEWABLE ENERGY CERTIFICATES AND WHITE CERTIFICATES.

AGRICULTURAL

COFFEE: THE GLOBAL COFFEE INDUSTRY IS ENORMOUS. IN THE UNITED STATES ALONE, IT ACCOUNTS FOR MORE THAN 1.6% OF GDP AND AN ESTIMATED 1.7 MILLION JOBS. AS A COMMODITY, COFFEE IS INTRIGUING FOR AT LEAST TWO REASONS. THE OVERWHELMING SUPPLY OF THE COMMODITY DERIVES FROM JUST FIVE COUNTRIES. AT THE SAME TIME, GLOBAL DEMAND FOR COFFEE CONTINUES TO GROW AS EMERGING MARKET ECONOMIES DEVELOP A TASTE FOR THE BEVERAGE.

CORN: CORN IS A COMMODITY WITH SEVERAL IMPORTANT APPLICATIONS IN THE GLOBAL ECONOMY. IT IS A FOOD SOURCE FOR HUMANS AND LIVESTOCK AS WELL AS A FEEDSTOCK USED IN THE PRODUCTION OF ETHANOL FUEL. THE HIGH COST OF SUGAR IN THE UNITED STATES HAS MADE CORN A KEY INGREDIENT IN SWEETENING PRODUCTS SUCH AS KETCHUP, SOFT DRINKS AND CANDIES. GROWING FOOD AND FUEL DEMAND GLOBALLY SHOULD DRIVE CONTINUED INTEREST IN CORN AS A COMMODITY.

SUGAR:

SUGAR IS NOT ONLY A SWEETENER, BUT IT ALSO PLAYS AN IMPORTANT ROLE IN THE PRODUCTION OF ETHANOL FUEL. HISTORICALLY, GOVERNMENTS ACROSS THE WORLD HAVE INTERVENED HEAVILY IN THE SUGAR MARKET. SUBSIDIES AND TARIFFS ON IMPORTS OFTEN PRODUCE ANOMALIES IN PRICES AND MAKE SUGAR AN INTERESTING COMMODITY TO TRADE. ALTHOUGH SUGAR CANE IS GROWN ALL OVER THE WORLD, THE TEN LARGEST PRODUCING COUNTRIES ACCOUNT FOR ABOUT THREE-QUARTERS OF ALL PRODUCTION.

SOYBEANS:

SOYBEANS PLAY A CRITICAL ROLE IN THE GLOBAL FOOD ECOSYSTEM. THE OIL FROM THE CROP IS USED IN MANY PRODUCTS INCLUDING BREAD, CRACKERS, CAKES, COOKIES AND SALAD DRESSINGS, WHILE THE MEAL FROM CRUSHED SOYBEANS SERVES AS THE MAIN SOURCE OF FOOD FOR LIVESTOCK. SOYBEAN OIL ALSO SERVES AS A FEEDSTOCK IN THE PRODUCTION OF BIOFUELS. THE GROWING NEED FOR FOOD AND FUEL IN EMERGING MARKET ECONOMIES COULD DRIVE DEMAND FOR SOYBEANS. THREE COUNTRIES – THE UNITED STATES, BRAZIL AND ARGENTINA – ACCOUNT FOR 80% OF GLOBAL PRODUCTION.

WHEAT:

WHEAT GROWS ON SIX CONTINENTS AND FOR CENTURIES HAS BEEN ONE OF THE MOST IMPORTANT FOOD CROPS IN THE WORLD. TRADERS COMPARE WHEAT PRICES TO OTHER GRAINS SUCH AS CORN, OATS AND BARLEY. SINCE THESE COMMODITIES CAN BE SUBSTITUTED FOR ONE ANOTHER, CHANGES IN THEIR RELATIVE PRICES CAN SHIFT DEMAND BETWEEN THEM AND OTHER PRODUCTS SUCH AS SOYBEANS. DEMAND FOR CHEAP AND NUTRITIOUS FOOD SOURCES IN DEVELOPING NATIONS SHOULD CONTINUE TO DRIVE INTEREST IN THE WHEAT MARKET.

ENERGY

CRUDE OIL

CRUDE OIL: THIS COMMODITY HAS THE LARGEST IMPACT ON THE GLOBAL ECONOMY. NOT ONLY IS CRUDE OIL USED IN A VARIETY OF FORMS OF TRANSPORTATION INCLUDING CARS, TRAINS, JETS AND SHIPS, IT IS ALSO USED IN THE PRODUCTION OF PLASTICS, SYNTHETIC TEXTILES (ACRYLIC, NYLON, SPANDEX AND POLYESTER), FERTILIZERS, COMPUTERS, COSMETICS AND MORE. IF YOU TAKE INTO ACCOUNT THE INPUT COST OF TRANSPORTATION, CRUDE OIL PLAYS A ROLE IN THE PRODUCTION OF VIRTUALLY EVERY COMMODITY. CRUDE OIL HAS DIFFERENT VARIATIONS BASED ON GEOGRAPHY AND PHYSICAL CHARACTERISTICS: WEST TEXAS INTERMEDIATE (WTI), ALSO KNOWN AS LIGHT SWEET CRUDE, AND BRENT CRUDE ARE TWO OF THE MOST FREQUENTLY TRADED VARIETIES.

NATURAL GAS:

NATURAL GAS IS USED IN A VARIETY OF INDUSTRIAL, RESIDENTIAL AND COMMERCIAL APPLICATIONS INCLUDING ELECTRICITY GENERATION. IT IS CONSIDERED A CLEAN FOSSIL FUEL SOURCE AND HAS GARNERED INCREASING DEMAND FROM MORE COUNTRIES AND ECONOMIC SECTORS. THE UNITED STATES AND RUSSIA HAVE EMERGED AS THE LEADING PRODUCERS OF THIS IMPORTANT GLOBAL COMMODITY.

GASOLINE:

THE MAIN USE OF THIS REFINED CRUDE OIL PRODUCT IS AS A SOURCE OF FUEL FOR CARS, LIGHT-DUTY TRUCKS AND MOTORCYCLES. GASOLINE PRICES CAN HAVE AN ENORMOUS EFFECT ON THE OVERALL ECONOMY SINCE DEMAND FOR THE COMMODITY IS GENERALLY INELASTIC. THAT IS, CONSUMERS NEED TO PUT GASOLINE IN THEIR VEHICLES TO GO TO WORK, SCHOOL AND OTHER ESSENTIAL ACTIVITIES. MANY TRADERS TRADE CRACK SPREADS, WHICH ARE THE DIFFERENCES BETWEEN CRUDE OIL PRICES AND THE PRICE OF REFINED CRUDE PRODUCTS SUCH AS GASOLINE.

METALS

GOLD:

GOLD IS A FASCINATING COMMODITY BECAUSE SO MUCH OF THE DEMAND FOR IT DERIVES FROM SPECULATORS. MANY MARKET PARTICIPANTS SEE GOLD AS AN ALTERNATIVE TO PAPER MONEY, SO THE PRICE OF THE COMMODITY OFTEN MOVES IN OPPOSITE DIRECTION FROM THE DOLLAR. GOLD IS ALSO USED TO MAKE JEWELRY AND ELECTRONICS.

SILVER:

MANY MARKET PARTICIPANTS VIEW SILVER AS THE POOR MAN’S GOLD. IT TOO RECEIVES SIGNIFICANT DEMAND FROM SPECULATORS AS WELL AS FROM JEWELRY AND OTHER INDUSTRIES. TRADERS TRACK THE RATIO BETWEEN GOLD AND SILVER PRICES SINCE HISTORICALLY THIS RELATIONSHIP HAS BEEN AN INDICATOR OF THE RELATIVE VALUE BETWEEN THE TWO METALS.

COPPER:

COPPER HAS SO MANY INDUSTRIAL USES THAT IT WOULD BE VIRTUALLY IMPOSSIBLE TO BUILD THE INFRASTRUCTURE OF A COUNTRY WITHOUT IT. TRADERS OFTEN REFER TO THE COMMODITY AS DR. COPPER. THEY SAY THE METAL HAS A PH.D. IN ECONOMICS BECAUSE ITS PRICE IS A RELIABLE BAROMETER OF THE OVERALL HEALTH OF THE GLOBAL ECONOMY. IN FACT, INVESTING IN COPPER IS A WAY TO EXPRESS A BULLISH VIEW ON WORLD GDP.

CRYPTOCURRENCIES

THE TERM CRYPTOCURRENCY COVERS A BROAD VARIETY OF DIGITAL TOKENS THAT CAN SERVE A NUMBER OF DIFFERENT PURPOSES. A TRADITIONAL CRYPTOCURRENCY LIKE BITCOIN IS DESIGNED TO ACT AS A FORM OF DIGITAL CURRENCY AND A STORE OF VALUE. OTHERS LIKE RIPPLE OR ETHEREUM ARE DESIGNED FULFILL A SPECIFIC PURPOSE AND ARE TARGETED AT SPECIFIC NICHES.

THE VAST MAJORITY OF CRYPTOCURRENCIES TAKE ADVANTAGE OF BLOCKCHAIN TECHNOLOGY. IN THEIR MOST SIMPLE FORM THEY USE CRYPTOGRAPHY TO PROCESS TRANSACTIONS AND CREATE NEW COINS, THIS PROCESS IS USUALLY PERFORMED BY COMPUTERS SOLVING COMPLEX EQUATIONS AND IS CALLED MINING. ALL PROCESSED TRANSACTIONS ARE STORED ON THE BLOCKCHAIN WHICH ACTS AS A GIANT COMPUTERIZED LEDGER.

THIS LEDGER CAN BE SHARED SIMULTANEOUSLY ACROSS THOUSANDS OF COMPUTERS AND ACTS AS AN IMMUTABLE RECORD OF ALL TRANSACTIONS THAT HAVE EVER TAKEN PLACE ON THE BLOCKCHAIN. THIS BASIC TECHNOLOGY ACTS AS THE FOUNDATION FOR MORE ADVANCED FEATURES SUCH AS SMART CONTRACTS.

CRYPTOCURRENCIES ARE POPULAR BECAUSE THEIR DECENTRALIZED NATURE ALLOWS FOR ENHANCED SECURITY AND PRIVACY. MANY USERS ALSO BELIEVE THAT IT HELPS TO PROTECT THEM FROM THE INTERFERENCE OF GOVERNMENTS AND COULD HELP TO BREAK THE MONOPOLY ON MONEY CURRENTLY ENJOYED BY THE BANKING SECTOR.

BITCOIN IS THE MOST WELL-KNOWN CRYPTOCURRENCY BUT THERE ARE HUNDREDS OF DIFFERENT CRYPTOCURRENCIES, KNOWN AS ALTCOINS. THESE ALTCOINS RANGE FROM MERE BITCOIN CLONES TO CURRENCIES LIKE RIPPLE OR NEO BUILT WITH SPECIFIC UTILITIES IN MIND.